Outsourcing Payroll: Pros & how to Do It

본문

Managing payroll can be time-consuming and complex. Payroll outsourcing services provide a structured solution by managing payroll processing and employee payments in your place. But how does payroll outsourcing work, and is it the ideal choice for your service?

This guide will explore outsourcing payroll benefits and drawbacks and how to begin.

Payroll outsourcing includes working with a third-party service provider to handle important payroll tasks, such as calculating employee salaries, processing direct deposits, handling benefits administration, and maintaining payroll records. This makes sure employees are paid properly and on time while lowering administrative burdens.

For organizations with remote teams, outsourced payroll services streamline payment management across different places, enabling business to concentrate on development rather of payroll intricacies.

Outsourcing Payroll: And Disadvantages

Benefits of Outsourcing Payroll

Time and Cost Savings: Handling payroll in-house requires substantial time and resources. Payroll outsourcing services allow organizations to save money and focus on growth instead of administrative tasks.

Accuracy and Compliance: Payroll errors can result in costly fines. Outsourcing makes sure accurate estimations.

Data Security: Payroll service providers utilize safe and secure systems to protect sensitive worker data, minimizing the danger of breaches or fraud.

Scalability: As your organization grows, managing payroll for more workers becomes challenging. Outsourced payroll service providers deal with increasing labor force needs effortlessly.

Global Payroll Solutions: For remote groups, payroll outsourcing simplifies payments throughout different nations, ensuring staff members are paid properly, despite location.

Disadvantages of Outsourcing Payroll

Initial Setup and Integration: Transferring payroll functions to an external service provider takes a little time, specifically when integrating with existing HR and accounting systems.

Service Costs: While outsourcing conserves time and resources, there's an expenditure connected with it. However, these costs often surpass the dangers of payroll mistakes and charges.

Luckily, unlike standalone payroll suppliers, Virtustant integrates payroll services straight with our staffing solutions-meaning you don't pay additional for payroll management. When you employ through us, we deal with everything from recruitment to payroll processing, making sure a seamless experience without extra expenses.

Schedule a free consultation with Virtustant today!

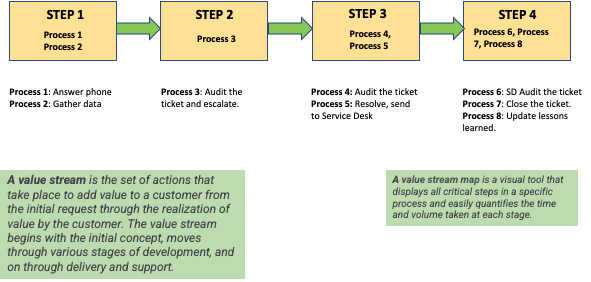

How to Outsource Payroll

If you're questioning how to outsource payroll, follow these key actions:

Assess Your Needs: Determine the level of payroll assistance needed, from standard processing to full-service management.

Choose a Respectable Provider: Research payroll providers with experience handling companies like yours, specifically for those with remote workers.

Ensure Security: Verify that the service provider abides by information security standards.

Stress-Free Payroll Management for Your Team

Payroll management is a time-consuming task that needs precision, compliance, and performance. As companies grow, managing payroll internally can become overwhelming. Outsourcing payroll services permits business to improve operations and guarantee timely payment, all while maximizing important time to concentrate on company development.

At Virtustant, we take this an action further by incorporating payroll contracting out with our staffing services. When you hire through us, you don't have to stress over payroll intricacies: we deal with whatever at no extra cost.

With our support, you can:

- Hire globally without payroll complexities.

- Ensure timely, compliant, and protected worker payments.

- Concentrate on scaling your service while we deal with administrative tasks.

Let us take the stress of payroll so you can concentrate on growing your company. Contact Virtustant today to improve your working with procedure easily and start scaling.

댓글목록0

댓글 포인트 안내